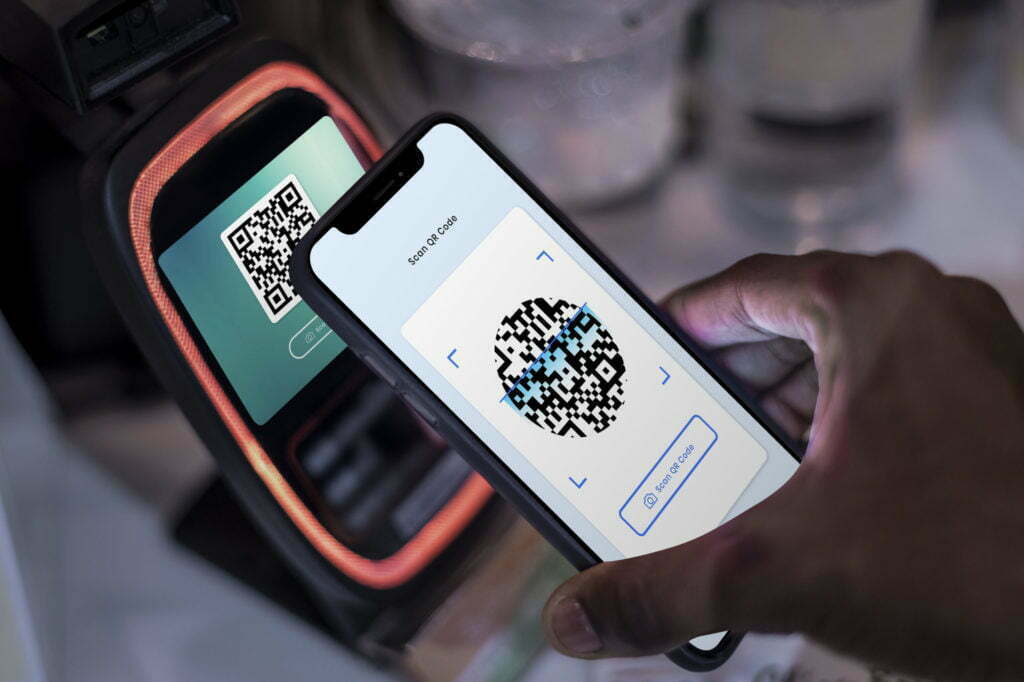

Mobile banking is the practice of conducting financial transactions on a mobile device such as a smartphone or tablet. This can include checking account balances, transferring funds, and paying bills.

The Benefits of Mobile Banking

With easy online mobile banking, you can access your bank account from anywhere at any time, which is why it’s become so popular. Traditional banking, on the other hand, is limited to brick-and-mortar locations, which can make it difficult to access your account if you’re not near one. Additionally, traditional banking often requires you to visit a bank branch in order to complete certain transactions, such as depositing a check. With mobile banking, you can complete all of your banking transactions from the comfort of your own home.

Another reason why mobile banking is more accessible than traditional banking is because there are more mobile banking options available. With traditional banking, you’re limited to the services offered by your bank. But with mobile banking, you can choose from a variety of mobile banking apps, which gives you more flexibility and control over your finances. Additionally, many mobile banking apps offer features that aren’t available with traditional banking, such as the ability to pay bills and transfer money.

Another benefit of mobile banking is that it’s often more convenient than traditional banking. With mobile banking, you can check account balances, view account activity, pay bills, and transfer money – all without having to go to a bank branch or wait on the phone. This can save you time and hassle.

Plus, mobile banking makes it easy to stay on top of your finances. You can receive account balances and activity notifications via text or email, so you’ll always be up-to-date on your account status. And, if you need to talk to a bank representative, you can easily do so with just a few taps on your phone.

And, finally, mobile banking can help you stay financially organized. With mobile banking apps, you can often create customized dashboards that show all of your account information in one place. This can make it easier to track your spending and budget your finances.

So if you’re looking for a more convenient, flexible, and easy-to-use banking experience, mobile banking is a great option. And, with so many banks now offering mobile banking apps, it’s easier than ever to get started.

Getting Started With Mobile Banking

Now that you understand the basics of mobile banking, it’s time to learn how to get started. Below are the simple steps to follow in order to start using mobile banking:

First, locate the mobile banking app for your financial institution. The app can be found in the app store or through a web browser on your mobile device. Some banks might even reach out to you directly with a link to download their mobile app. Check your email inbox or texts from your bank to see if this is the case.

Once you have located the app, you will need to download it to your mobile device. After it is installed, open the app and sign in using your online banking credentials. If you do not have online banking credentials, you will need to contact your financial institution to set them up.

Once you are logged in, you will be able to view your account balances and transactions, as well as make transfers and payments. You can also set up notifications to be alerted when your account balance falls below a certain threshold or when a specific transaction occurs.

The app also allows you to view your account history, statements, and investment portfolio. You can also find ATMs and branches near you, as well as contact customer service.

That’s it! You are now ready to reap the benefits of mobile banking.